Lupine Publishers| Journal of Textile and Fashion Designing

Abstract

Since the 1990s the Internet affected different industries and forced firms to change their business models and pushed toward the adoption of new strategies. The same happened in fashion industry, where e-commerce, personal computers, and smartphones created the opportunity for fashion firms to be closer to their customers, adopting CRM, and multichannel or omnichannel strategies. The main aim of this study is to analyze the potential conflicting presence of online and brick-and-mortar strategies in the fashion industry. We used a representative sample of 19 large firms in Europe, operating in the retailing brand fashion industry. Our data analysis shows how leading firms, facing a disruptive technology (the emergence of e-commerce), have been able to absorb it, in a context of co-existence between online and brick-and-mortar strategies.

Keywords:Innovation; Fashion Industry; Brick-and-Mortar; Commerce Online; Business Model

Introduction

Since the 1990s, many firms working in retailing adopted innovations spurred from Internet, such as e-commerce, to better service their customers. After a while, the entire fashion industry started using the online channel, either as exclusive channel or adopting multichannel or ominchannel strategies. Scholars focused on the adoption of e-commerce in fashion, studying the market structure [1-3], the use of the Internet, and the development of multichannel or omichannel selling modes [4-7]. Analyzing the changes occurred in the retailing industry, they showed the emergence of new business models among firms operating in the market [6,8-11].

The aim of this work is to provide some evidence about the effect of a disruptive technology like e-commerce, showing that this is still not cannibalizing the market of fashion. In section 2 we will shortly present the main research questions, in section 3 we will go through a short literature review. In section 4 we will present the methodology adopted. In section 5 we will present and discuss our data, and, finally, in section 6 we will conclude this paper.

The Aim of this Study and the Main Research Questions

The aim of this study is to show the disruptive effect of the entry of new technologies (e-commerce) in the fashion industry. Are we assisting to the failure of the main incumbents? Are firms operating in the fashion market suffering because of the presence of the e-commerce? Are existing large incumbents in the fashion industry able to absorb the new technology? All these questions can be summarized just in one main research question: do we have a cannibalization process between online and brick-and-mortar business models? In order to provide an answer, we collected data about the international investments made by a sample of 19 large fashion retailing firms operating in Europe.

Literature Review

Christensen, in his book “The innovators dilemma” [13], used the term disruptive technologies to explain why companies, that stay at the top of their industry, fail when they face a technological change. He provided evidence about the fact that it is costly for existing firms to adopt a new innovation and/or change the market. In contrast, Tripsas [14], using the history of the typesetter industry, provided some evidence about the fact that incumbents may survive, being able to absorb the new technology, due to their technical capabilities in learning from the new technology and in developing complementary assets. Many scholars agree on the fact that the introduction of radical and breakthrough innovations tends to stimulate the change of the incumbent business models [15-25]. Today, there is a general consensus on the idea that the transformation of a firm’s business model is crucial for firms’ renewal [26].

During the 1990s, in fashion retail, we saw the rise of new internet-based firms [27], but simultaneously a large reorganization of the firms’ value chains occurred. Increasingly, due to the complexity of ICT adoption, users developed an unpredictable pattern of hybrid forms [28-31]. Thus, nowadays, we may observe not only the rise of new internet-based firms (e.g. the German Zalando or the French Vent-Privée), but also new “reorganized” traditional fashion brand retailers [9-12]. Socrescu et al. [6] and Vorhoef et al. [8] have underlined how ICT allowed firms to be closer to their customers, increasing brand awareness and customers’ loyalty [4-7]. The use of the multichannels modality, allowed firms to develop new business models, integrating in their operative activity the online business, selling on-line [4,32,33] through ample catalogues and through the shops (where on-line orders could be collected). In more recent years, the “omni-channel” opportunity become more significant, thanks to the use of mobile apps linked to different devices: smartphones, tablets, and other devices [34-36].

An interesting contribution to the explanation why “hybrid” business model (on-line and offline) are successful has been provided by Bernstein et al. [24]: firms do not benefit very much from online sales (in terms of profits’ growth), but consumers do; thus, traditional retailers have to adopt the online new commercial channels for strategic purposes.

Methodology

Starting from information available in the FDI Markets database, provided by the Financial Times Group, which collect individual firm FDI operations, we selected a sample of the largest retailers firms, operating the in fashion retail industry in Europe, sampling both luxury and low costs large retailers. The unit of analysis is the FDI specific investment. Then, using Thomson Reuters database, we add the information on yearly sales, and number of shops opened and closed in the world. Where some data where incomplete, we filled the gap looking at the annual financial report. We included in our sample 19 large retailers. When it was possible, we unbundle data for the specific brand of the group. The period analyzed was 2008-2016.

Data Analysis

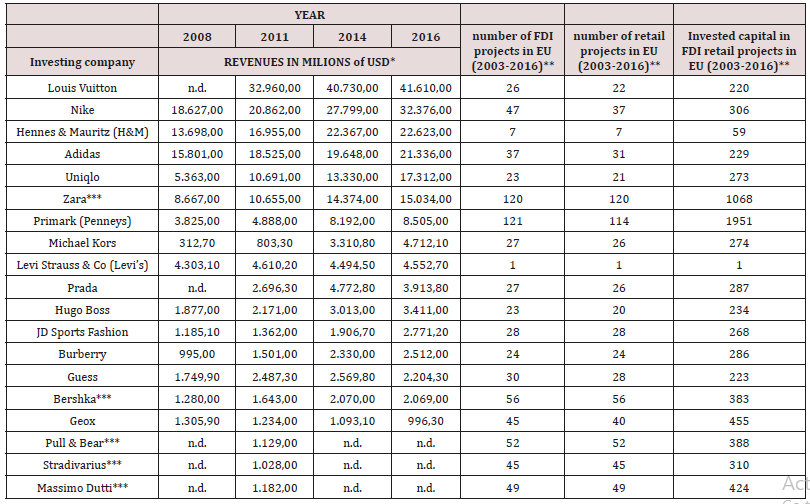

Table 1: List of fashion retailers by sales (2008 - 2016) millions of dollars.

n.d. : no data are available

*Data available on Thomson Reuters

**Data from FDI Markets Database

***Inditex group

Source: authors’ elaboration on Thomson Reuters data

Table 1 shows the list of the largest investing company and the revenues expressed in millions of US dollar. The largest firms analyzed are Louis Vuitton (luxury segment), Nike, H&M, Adidas and Zara. Their sales oscillate from 40 billion to 17 billion. The typical firm in the luxury market is smaller with sales ranking from 4 to 2 billion (Prada, Hugo Boss, and Michel Kors). All firms, in this period, showed an increasing growth trend, with the exception of Geox. The biggest firms in terms of number of shops are H&M (4351), Louis Vuitton (3948), Levi Strauss &Co (2900), Adidas (2811) and Zara (2002). In our database is also included a large Japanese retailer, Uniqlo. In the period observed all firms showed a very positive increase in the number of shops opened (Adidas opened 927 new shops, Bershka 534, Pull&Bear, 417, Massimo Dutti and Stradivarius 569). Even if the introduction of e-commerce affected the market, the old brick-and-mortar business model is not dying. As it is shown, all firms (with the exception of Primark) adopted the e-commerce and transformed themselves into on-line/offline retail organizations. They both adopted new models of selling, opening on average each year more than 12% of new shops.

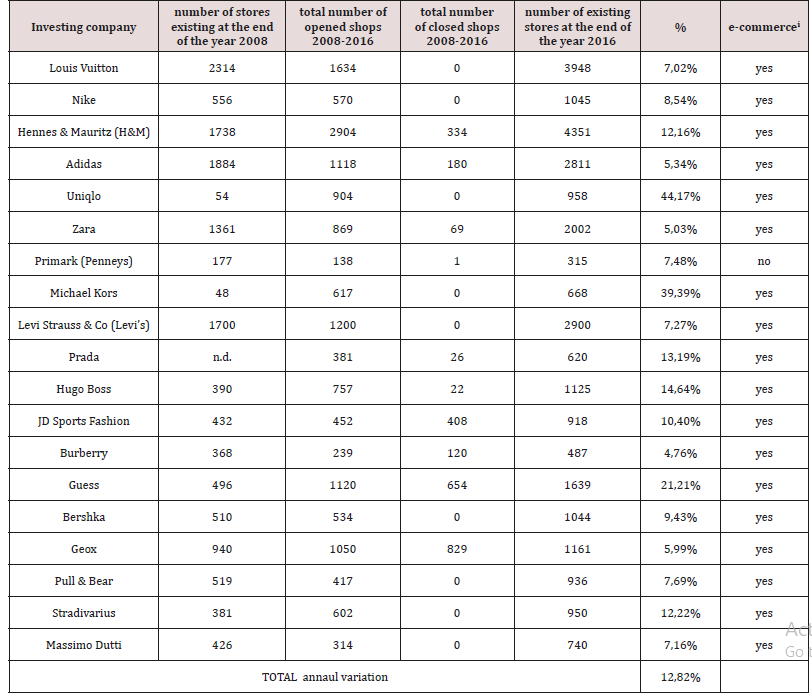

Table 2: Number of shops opened and closed per each firm in the world, the total number of shops at the end of the period, and e-commerce presence.

i: our analysis on firms’ web sites. Source: authors’ elaboration on Thomson Reuters data.

Thus, even if new players entered the market (such as Amazon, Zalando, Yoox, and many others), large incumbents did not fail. Sales through e-commerce are disclosed by firms in the financial reports. Zara, Adidas and Hugo Boss, declared a percentage of e-commerce sales on total sales between 5 and 7% in the last years (Table 2).

Conclusion

The aim of this paper was to analyse the impact of e-commerce on traditional retailing. In the first part of the paper, we went through a short literature review, showing how e-commerce is an innovation which can deeply transform the fashion industry. In the same vein, this literature highlights how this topic can be analysed from different approaches (e.g. business model, innovation, and others). In the second part of this work we showed some data obtained by two different databases. Data support our idea that there is no cannibalization among the online and brick-and-mortar channels. This work has some limitations. The number of firms chosen for this analysis in not too large. Then, another limitation is due to the fact that official databases contain only few information about online business.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.